This was the week that was. Question? What happened?

This past week was quite interesting. Why? Because the weakness in these markets is obvious and simple to understand. However, if you're in denial, then nothing said here will make sense to you. Just for clarity, we have stated many times, this is not a correction, it is a systemic collapse. And, these markets will continue to decline until valuations can be stabilized. The huge systemic problem is that excess leverage has distorted values to the point of insanity.

This week, there were massive sell-offs in BOTH the bond markets and stock markets. Worse yet, this is a global condition. Also, the two bond auctions that occurred were dismal, i.e. no buyers. That is a display of lack of confidence, and coming from institutional investors spells big trouble. Then ,add in the global weakness in the US dollar, and the perfect storm is building.

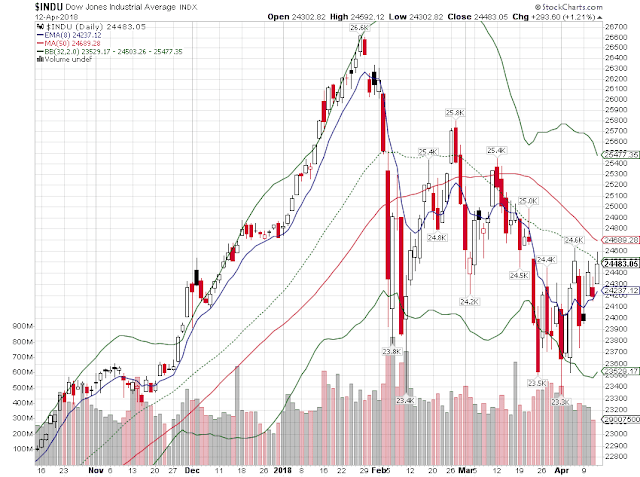

Take a look at the chart below. In spite of a 330 point run up in the last hour of trade today (which was probably the work of the Plunge Protection Team), the DJIA could NOT get up to the 50 moving average. With the DJIA below the Trend line and the 50 day moving average, this downward trend is here to stay for a while.

It's important to examine this chart closely. Not only did key indicators show weakness, but the volume is climbing while prices decline. Volume is like voting, the more volume, the more downward momentum.

How low will it go before you do something? How much can you afford to lose? Think about it.

This week, there were massive sell-offs in BOTH the bond markets and stock markets. Worse yet, this is a global condition. Also, the two bond auctions that occurred were dismal, i.e. no buyers. That is a display of lack of confidence, and coming from institutional investors spells big trouble. Then ,add in the global weakness in the US dollar, and the perfect storm is building.

Take a look at the chart below. In spite of a 330 point run up in the last hour of trade today (which was probably the work of the Plunge Protection Team), the DJIA could NOT get up to the 50 moving average. With the DJIA below the Trend line and the 50 day moving average, this downward trend is here to stay for a while.

It's important to examine this chart closely. Not only did key indicators show weakness, but the volume is climbing while prices decline. Volume is like voting, the more volume, the more downward momentum.

How low will it go before you do something? How much can you afford to lose? Think about it.

Comments

Post a Comment