Watch out. They are about to set the hook and real in the fish !

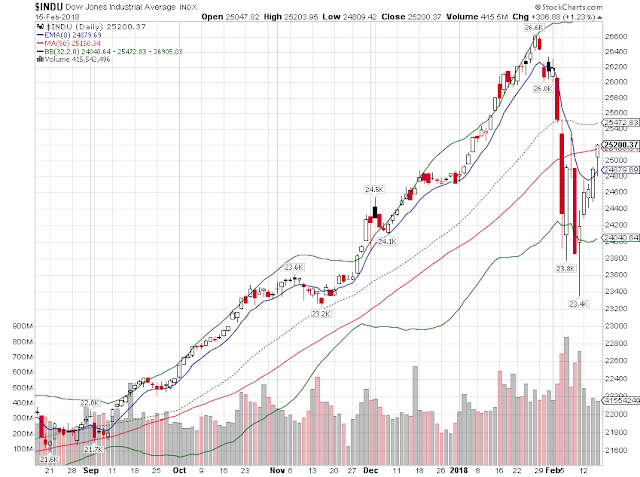

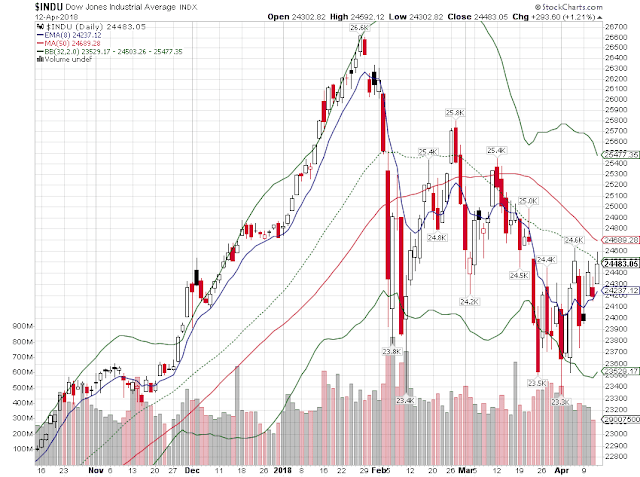

Here we are staring down the biggest "bull trap" in history! So, what exactly is a "bull trap"? It's a "head fake" to entice investors (mainly retail investors and inexperienced fund managers) into BUYING stocks that are about to collapse. Before we go on, let's take a good hard look at today's chart.

Notice that the market closed just ABOVE the 50 day moving average AND the blue 8 day exponential moving average (trend line). That would be great IF it was "supported" by volume. And here's the nuance of this chart. NOTICE that when the market is going DOWN, the volume is HIGH; and when the market is going UP, the volume is LOW. Indeed, from the looks of it, it appears that pesky little Plunge Protection Team (PPT), run out of the New York Reserve Bank is once again rigging the markets. But, that proves nothing you say? Take a closer look, for the last 3 "down" days, it has taken 5 "up" days to recover their losses. But, did they really? NOPE, look again at the volume. The AMOUNT of losses remain FAR GREATER than the amount of gains! That's an important point to remember.

Now, in conjunction with the market rigging, the talking heads, those arrogant little infomercial prima donnas on Bloomberg, CNBC, and Fox Business were already hyping this "rally". The "dip" is over they said. One "expert" on Bloomberg was selling ETF (Exchange Traded Funds), and how NOW is the perfect time to get in. On CNBC, another "expert" was pushing utility stocks, and how NOW is the time to pick up these "bargains". CNBC, Bloomberg and Fox are nothing more than nonstop infomercials for Wall Street. They are masquerading as "news'. In a word, it's all BULLSHIT. I find it hard to believe that all of these people "reporting" financial news" are really this stupid! By far, Jim Cramer (former Goldman Sachs flunky) is the worst. And it is criminal how these people are leading millions of people into abject poverty with such flagrant misinformation.

As Mohammad El-Erian had explained many many months ago, the markets will need to establish "valuation equilibrium" before it would be wise to invest. For the last few weeks, what happened to Mohammad. Not a peep out of him anywhere! The news stations are NOT putting him out there, I wonder why!

Something else you should notice, the recent little quips and comments about inflation starting to pick up. Those brief references are designed to condition the public for what's about to happen. By using this "inflation is good for us now" narrative, when the brunt of the dollar collapse starts to show, nobody will be alarmed. You see the problem of valuation STARTS with the US dollar, which has taken some serious hits around the globe lately. And, it's going to get worse.

By combining the problems of a weak dollar (and getting weaker) as a foundation on top of the insane leverage created out of debt which floats the stock and bond markets, to re-establish "valuation equilibrium", we are looking at a market decline in the 70-80% range. And here's the kicker! If DeutscheBank goes down, all of the corresponding banks tied in with their derivatives scheme will go with them. Derivatives and their parent, debt, have created unsustainable leverage. So, here again, we're NOT talking about a "dip", "pullback", or "correction"; we're talking about a full-on systemic collapse that NOBODY is prepared for. At this moment, the ONLY asset class that is NOT tied to debt is, of course, cryptocurrencies.

When this "bull trap" is snapped, people will get hurt. The losses will be staggering, far worse than 2008 or 2000 or 1987! This is not an academic theory, but it is a correlation of history that happened nearly 300 years ago. Here we go again.

Now, in conjunction with the market rigging, the talking heads, those arrogant little infomercial prima donnas on Bloomberg, CNBC, and Fox Business were already hyping this "rally". The "dip" is over they said. One "expert" on Bloomberg was selling ETF (Exchange Traded Funds), and how NOW is the perfect time to get in. On CNBC, another "expert" was pushing utility stocks, and how NOW is the time to pick up these "bargains". CNBC, Bloomberg and Fox are nothing more than nonstop infomercials for Wall Street. They are masquerading as "news'. In a word, it's all BULLSHIT. I find it hard to believe that all of these people "reporting" financial news" are really this stupid! By far, Jim Cramer (former Goldman Sachs flunky) is the worst. And it is criminal how these people are leading millions of people into abject poverty with such flagrant misinformation.

As Mohammad El-Erian had explained many many months ago, the markets will need to establish "valuation equilibrium" before it would be wise to invest. For the last few weeks, what happened to Mohammad. Not a peep out of him anywhere! The news stations are NOT putting him out there, I wonder why!

Something else you should notice, the recent little quips and comments about inflation starting to pick up. Those brief references are designed to condition the public for what's about to happen. By using this "inflation is good for us now" narrative, when the brunt of the dollar collapse starts to show, nobody will be alarmed. You see the problem of valuation STARTS with the US dollar, which has taken some serious hits around the globe lately. And, it's going to get worse.

By combining the problems of a weak dollar (and getting weaker) as a foundation on top of the insane leverage created out of debt which floats the stock and bond markets, to re-establish "valuation equilibrium", we are looking at a market decline in the 70-80% range. And here's the kicker! If DeutscheBank goes down, all of the corresponding banks tied in with their derivatives scheme will go with them. Derivatives and their parent, debt, have created unsustainable leverage. So, here again, we're NOT talking about a "dip", "pullback", or "correction"; we're talking about a full-on systemic collapse that NOBODY is prepared for. At this moment, the ONLY asset class that is NOT tied to debt is, of course, cryptocurrencies.

When this "bull trap" is snapped, people will get hurt. The losses will be staggering, far worse than 2008 or 2000 or 1987! This is not an academic theory, but it is a correlation of history that happened nearly 300 years ago. Here we go again.

Comments

Post a Comment