Take cover! This is not a drill. Take cover now while you still can.

The US markets are so manipulated that real market action appears mundane. The propaganda machine, or mind control, or whatever, has created a mindset of apathy or disbelief. So, let's pay attention to reality.

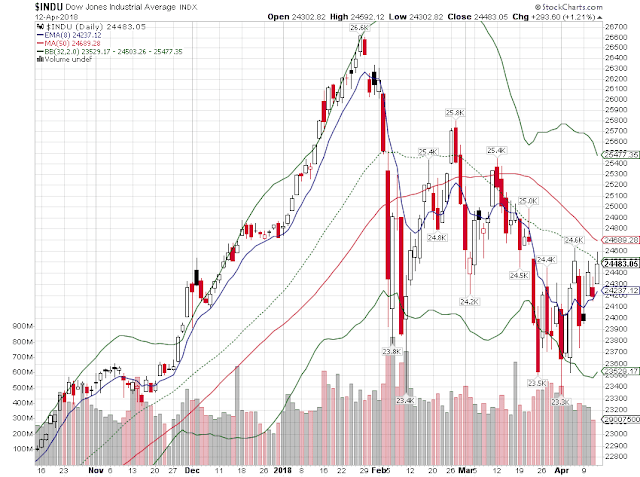

Most of you are not technical traders or experienced traders of any success. So, it may be hard to understand Japanese candlestick charts and what their formations indicate. Regardless of your experience level, just understand that recent charts have indicated a STRONG trend reversal. In this case, the trend reversal would be DOWN. An important nuance to this trend is volume. Volume is very important to discern if there is momentum behind a trend. In other words, if more trades are occurring when stocks are moving down, then the momentum says the market is moving down. So, the candlestick formations AND the volume are both strongly showing big down momentum now and it's building.

In spite of those warning signs, most people appear to be complacent about this present condition. As a perspective, remember the 2008 crash? It was September 29, 2008, and the DJIA dropped 777.68 points. As a "fix", back in 2008, we were told that trading curbs would be put in place to prevent a repeat of this crash. The number 1,000 was bantered around, and people accepted that if the market were to crash again, at 1,000 point drops, the trading curbs or circuit breaker would be triggered. But, that's NOT what they actually did. The trading curbs or circuit breakers were set to 7%, 13%, 20% declines. Those percentages were actually never explained to the public. They were quietly implemented without even the usual media hype that follows a "one day rally". Interestingly, those percentage levels coincide with the federal bankruptcy rules, chapter 7, chapter 13, and if you want to totally screw a lender, combine the two into what we called in the business a "chapter 20".

The point of this narrative is simply that today's market conditions are roughly 300 TIMES worse than they were in 2008. Nothing has been resolved about the dangers of derivatives! Both stocks AND bonds are insanely overvalued and teetering on collapse. The Plunge Protection Team (PPT) has nearly or already has exhausted all of the funds of the Economic Stabilization Fund (ESF). And even with the back drop of the 2008 crash, the February 5th 1,175 point drop in the DJIA, AND the February 8th 1,033 point drop has NOT moved investors out of the markets. Investors seem oblivious, if not comatose, to their own imminent financial destruction. Frankly, I have never seen anything like this! Is this mass mind control or the manifestations of an Orwellian nightmare gone wild?

Quietly, day after day, news articles from around the world are covering stories of banks and governments which are now embracing the cryptocurrency solution. They can see quite clearly what is happening! The fiat currency system manipulated by central banking is collapsing right before your eyes, and these institutions know it. But, take a closer look, none of them are sounding the alarm bells. Millions of people will be wiped out. But, if they say something now, that could start a "run on the bank", but this run would be much bigger and global. People could exit the central bankers' fiat system and protect their assets within the cryptocurrency system. But, that truth will not be revealed until the damage is already done. Banks and governments must continue to serve their masters, the Rothschilds and their global banking cartel, until the bitter end. It's a HUGE CLUB and YOU ain't in it!

So, again, let's examine today's chart, We remain on course for the big one, a collapse! Again, weakness is shown by the sell-off into the close. The PPT must be nearly out of money, and that's when this thing lets go.

Look closely. We are back BELOW the Trend Line(blue line) and solidly BELOW the 50 day moving average(red line)! This isn't pretty!

What you can not see from this chart is the corresponding sell off in the bond markets. All of the yields are up! Meanwhile, the Fed is trying to auction off another $250 Billion in additional debt. Whether you subscribe to the "new math" concept or not, you can NOT get out of debt by creating MORE debt!

I can hear Dr. Albert Schweitzer now, "the single biggest problem in this world is that people don't THINK."

For comparison, let's examine a Bitcoin to US Dollar chart. (USD/BTC)

The Green lines are the Bollinger band, the Yellow Line is the Trend Line, and the Red line is the 50 day moving average.

Today, bitcoin came down to the Trend Line while the price action remained ABOVE the trend line.(We're NOT below it yet.) THAT is a "pull back". There is some slight resistance at the 50 day average, but over the next 3 days that should evaporate. Once it does, look for Bitcoin to continue its move up to the $37,000 range and probably $64,000 by mid-summer.

If you're considering other cryptocurrencies in which to invest, keep in mind, at the moment, bitcoin is an excellent bellwether for most of the popular cryptocurrencies. Getting ahead of this collapse will make a lot of people very wealthy. Once the markets break, things will happen very fast. So, be prepared, i.e. read the posts and pages of this blog. Above all else, NOW is the time to do something to protect yourself!

Most of you are not technical traders or experienced traders of any success. So, it may be hard to understand Japanese candlestick charts and what their formations indicate. Regardless of your experience level, just understand that recent charts have indicated a STRONG trend reversal. In this case, the trend reversal would be DOWN. An important nuance to this trend is volume. Volume is very important to discern if there is momentum behind a trend. In other words, if more trades are occurring when stocks are moving down, then the momentum says the market is moving down. So, the candlestick formations AND the volume are both strongly showing big down momentum now and it's building.

In spite of those warning signs, most people appear to be complacent about this present condition. As a perspective, remember the 2008 crash? It was September 29, 2008, and the DJIA dropped 777.68 points. As a "fix", back in 2008, we were told that trading curbs would be put in place to prevent a repeat of this crash. The number 1,000 was bantered around, and people accepted that if the market were to crash again, at 1,000 point drops, the trading curbs or circuit breaker would be triggered. But, that's NOT what they actually did. The trading curbs or circuit breakers were set to 7%, 13%, 20% declines. Those percentages were actually never explained to the public. They were quietly implemented without even the usual media hype that follows a "one day rally". Interestingly, those percentage levels coincide with the federal bankruptcy rules, chapter 7, chapter 13, and if you want to totally screw a lender, combine the two into what we called in the business a "chapter 20".

The point of this narrative is simply that today's market conditions are roughly 300 TIMES worse than they were in 2008. Nothing has been resolved about the dangers of derivatives! Both stocks AND bonds are insanely overvalued and teetering on collapse. The Plunge Protection Team (PPT) has nearly or already has exhausted all of the funds of the Economic Stabilization Fund (ESF). And even with the back drop of the 2008 crash, the February 5th 1,175 point drop in the DJIA, AND the February 8th 1,033 point drop has NOT moved investors out of the markets. Investors seem oblivious, if not comatose, to their own imminent financial destruction. Frankly, I have never seen anything like this! Is this mass mind control or the manifestations of an Orwellian nightmare gone wild?

Quietly, day after day, news articles from around the world are covering stories of banks and governments which are now embracing the cryptocurrency solution. They can see quite clearly what is happening! The fiat currency system manipulated by central banking is collapsing right before your eyes, and these institutions know it. But, take a closer look, none of them are sounding the alarm bells. Millions of people will be wiped out. But, if they say something now, that could start a "run on the bank", but this run would be much bigger and global. People could exit the central bankers' fiat system and protect their assets within the cryptocurrency system. But, that truth will not be revealed until the damage is already done. Banks and governments must continue to serve their masters, the Rothschilds and their global banking cartel, until the bitter end. It's a HUGE CLUB and YOU ain't in it!

So, again, let's examine today's chart, We remain on course for the big one, a collapse! Again, weakness is shown by the sell-off into the close. The PPT must be nearly out of money, and that's when this thing lets go.

Look closely. We are back BELOW the Trend Line(blue line) and solidly BELOW the 50 day moving average(red line)! This isn't pretty!

What you can not see from this chart is the corresponding sell off in the bond markets. All of the yields are up! Meanwhile, the Fed is trying to auction off another $250 Billion in additional debt. Whether you subscribe to the "new math" concept or not, you can NOT get out of debt by creating MORE debt!

I can hear Dr. Albert Schweitzer now, "the single biggest problem in this world is that people don't THINK."

For comparison, let's examine a Bitcoin to US Dollar chart. (USD/BTC)

The Green lines are the Bollinger band, the Yellow Line is the Trend Line, and the Red line is the 50 day moving average.

Today, bitcoin came down to the Trend Line while the price action remained ABOVE the trend line.(We're NOT below it yet.) THAT is a "pull back". There is some slight resistance at the 50 day average, but over the next 3 days that should evaporate. Once it does, look for Bitcoin to continue its move up to the $37,000 range and probably $64,000 by mid-summer.

If you're considering other cryptocurrencies in which to invest, keep in mind, at the moment, bitcoin is an excellent bellwether for most of the popular cryptocurrencies. Getting ahead of this collapse will make a lot of people very wealthy. Once the markets break, things will happen very fast. So, be prepared, i.e. read the posts and pages of this blog. Above all else, NOW is the time to do something to protect yourself!

Comments

Post a Comment