Things are really rickety at the moment.

We have been warning and warning about the dangerous levels in the stock and bond markets, hoping that most of you would take safe haven in cryptocurrencies. Alas, many of you may find these warnings annoying or even entertaining because your confidence is secured in your favorite fund manager's views or opinions of the current market. We have only a little over 45 years experiences in this subject, so when we found this statement on ZeroHedge today, we were quite surprised. ZeroHedge stated " over 60% of fund management professionals have less than 8 years market experience ."

Here's their article.

Again, we reviewed ZeroHedge's article about the markets' technical fundamentals, and surprise! They agreed with us. Things are shaky!

Not to be redundant, but ZeroHedge hit the nail on the head AGAIN on the underlying weakness that WILL rear its ugly head soon. The GDP forecast does NOT support this present day market exuberance!

Yet again, ZeroHedge pointed out that even the Fed Chairman says this financial path is unsustainable.

Even with all of that information in front of us, many folks have been led to believe that they are SAFE in the stock or bond markets. In fact, the recent media maligning of bitcoin and other cryptocurrencies has actually been designed to scare off investors. The very Wall Street bankers that have been filling you full of fear & doubt about bitcoin and cryptocurrencies are actually secretly building huge investments in cryptocurrencies. They want to control this asset class BEFORE you do! If cryptocurrencies are so volatile and dangerous, then WHY is Goldman Sachs BUYING a cryptocurrency exchange?

To be blunt, underlying fundamentals have to be in place to support wildly optimistic market moves like we have seen for the past year. Those fundamentals are NOT there. The economy is much weaker than anyone wants to admit. A weak dollar, a weak economy, and over inflated market values are a recipe for disaster. There is NO getting around it. YOU are quickly running out of time to protect yourself.

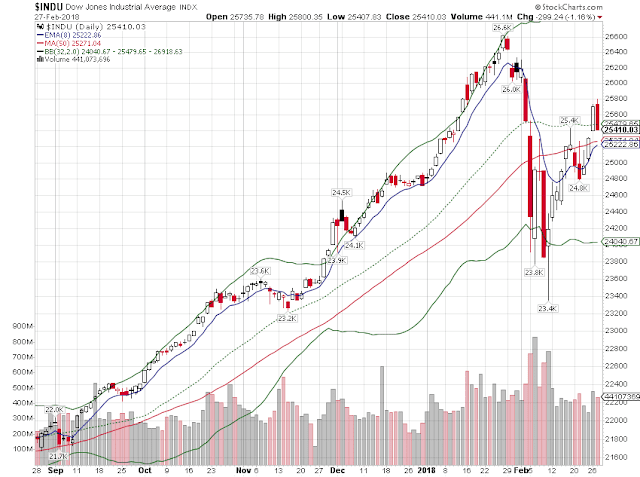

Today's chart shows the vulnerability of the retail investor!

Hmmm, we spent three days above the 50 day moving average, and that third day gave up ALL of the gains of the second day! That's not a good thing.

Here's their article.

Again, we reviewed ZeroHedge's article about the markets' technical fundamentals, and surprise! They agreed with us. Things are shaky!

Not to be redundant, but ZeroHedge hit the nail on the head AGAIN on the underlying weakness that WILL rear its ugly head soon. The GDP forecast does NOT support this present day market exuberance!

Yet again, ZeroHedge pointed out that even the Fed Chairman says this financial path is unsustainable.

Even with all of that information in front of us, many folks have been led to believe that they are SAFE in the stock or bond markets. In fact, the recent media maligning of bitcoin and other cryptocurrencies has actually been designed to scare off investors. The very Wall Street bankers that have been filling you full of fear & doubt about bitcoin and cryptocurrencies are actually secretly building huge investments in cryptocurrencies. They want to control this asset class BEFORE you do! If cryptocurrencies are so volatile and dangerous, then WHY is Goldman Sachs BUYING a cryptocurrency exchange?

To be blunt, underlying fundamentals have to be in place to support wildly optimistic market moves like we have seen for the past year. Those fundamentals are NOT there. The economy is much weaker than anyone wants to admit. A weak dollar, a weak economy, and over inflated market values are a recipe for disaster. There is NO getting around it. YOU are quickly running out of time to protect yourself.

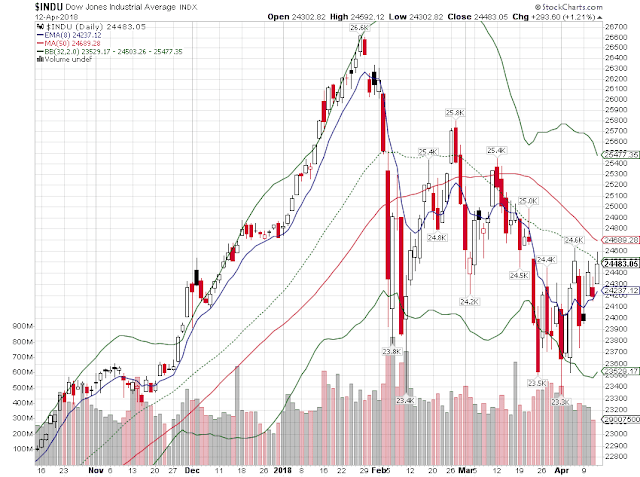

Today's chart shows the vulnerability of the retail investor!

Hmmm, we spent three days above the 50 day moving average, and that third day gave up ALL of the gains of the second day! That's not a good thing.

Comments

Post a Comment