After Next Week.... LOOK OUT!

There is a lot of pressure building behind a near future cryptocurrency price explosion. We have been warning about this for weeks. The weakness in the stock markets, bond markets, and US dollar have set up the perfect storm.

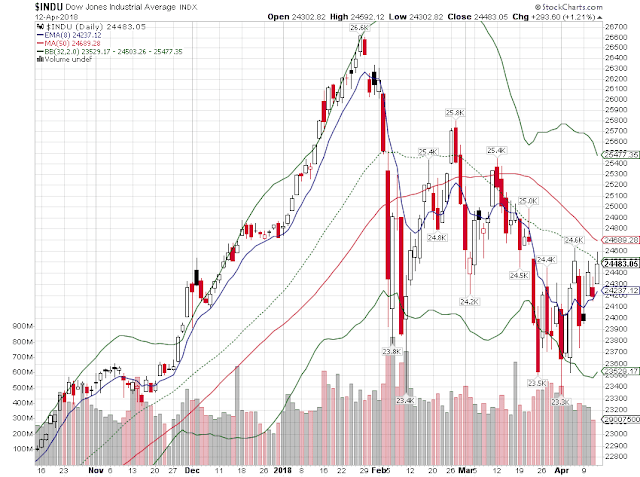

Take a look at the DJIA chart for Friday, April 13th.

Not surprising it's down again. Even the average commentator on CNBC and Bloomberg have noted the weak volume with the price upswings while volume ticks up on lower prices. Sadly, the bond markets are in worse shape and are far more dangerous! Another nuance to this situation is the DOWN GRADE of DeutscheBank to A-, just a hair above junk, and that's being generous.

When this system breaks, things will happen fast. You had better be ready. There are no "do-overs." The global financial world does NOT grade on a curve. DeutscheBank has been giving off warning signals and hints for months!

Take a look at that "almighty" US dollar.

This has weakness written all over it! If US stock markets are UP while the underlying currency, the dollar, is DOWN, what have you gained? Look at VALUE not numbers!

This has weakness written all over it! If US stock markets are UP while the underlying currency, the dollar, is DOWN, what have you gained? Look at VALUE not numbers!

Take a look at the DJIA chart for Friday, April 13th.

Not surprising it's down again. Even the average commentator on CNBC and Bloomberg have noted the weak volume with the price upswings while volume ticks up on lower prices. Sadly, the bond markets are in worse shape and are far more dangerous! Another nuance to this situation is the DOWN GRADE of DeutscheBank to A-, just a hair above junk, and that's being generous.

When this system breaks, things will happen fast. You had better be ready. There are no "do-overs." The global financial world does NOT grade on a curve. DeutscheBank has been giving off warning signals and hints for months!

Take a look at that "almighty" US dollar.

This has weakness written all over it! If US stock markets are UP while the underlying currency, the dollar, is DOWN, what have you gained? Look at VALUE not numbers!

This has weakness written all over it! If US stock markets are UP while the underlying currency, the dollar, is DOWN, what have you gained? Look at VALUE not numbers!

If you have been following this blog, you know and understand WHY cryptocurrencies are positioned to explode in value. The Wall Street folks are prepared to dump TRILLIONS into the cryptocurrencies over this coming year. Many of you will be shocked at the profits you'll be earning this year and for a few years to come. To have yourself positioned for this huge windfall will be the single biggest strategic decision you may ever do in this lifetime.

When this transition of Wall Street starts (within the next 30 days), there will be a lot of volatility in the cryptocurrency space moving up in value quickly. This really is a once in a lifetime opportunity to blow the doors off of your investment portfolio. Recently, we found an amazing software package that anybody can afford to use to leverage their profits and earnings at this important time in history! You must be prepared to grab as much as you can while you can. This software is newbie friendly and yields incredible DAILY returns, even profitable returns in just mere minutes for the beginner. We highly recommend this software tool for your financial arsenal. This is the one cryptocurrency tool you can start using right now, making remarkable profits even before the BIG push starts! You absolutely MUST see this! Timing is critical.

Wednesday April 18, 2018 looks to have been potentially a major tipping point in the market. There was a massive sell off in the bond market in spite of all kinds of money printing to try and prop it up. This while the stock markets remained relatively flat so the money was not going back into the stock market from the bond market. Additionally the dollar continued it's decline in value below 90 heading toward 88. These 2 factors should have caused a significant stock market rise but they did not. To add to the dangerous situation the bond yield curve between the 2 yr and 10 yr bonds can not flatten any more without inverting. This is caused by the attempt to prop up the bond market. Historically every time the yield curve inverts there is a major market crash. This happened in 1987, 2000, and 2007 to name a few. I think it is not weeks away but more likely days and maybe only hours away. When and if it pops you better be ready. Potentially anything you do not physically posess in your hands will evaporate into nothing. This includes gold, silver, and cash, on deposit with banks or storage depositories, or brokerage, and paper representations of value such as stock certificates, commodities contracts, debt instruments owed to you, crypto currencies left on exchanges as opposed to you personally holding and controlling the public and private keys. A few weeks after such a crash even the value you hold in Federal Reserve Notes you physically hold in your hands could evaporate to having no value. When credit markets seize up the store shelves will empty fast so you need to be ready. Better safe than sorry.

ReplyDeleteltcjdh - EXCELLENT COMMENT!! On point! Thanks!

Delete