Look around, maintain situational awareness. We're inching closer to the END.

At this moment in time, let's take stock, or review, the present situation, or as some people like to say "maintain situational awareness". Or more folksy and to the point, "pay attention blockhead, the shit is about to hit the fan". 2018 is the year the great collapse will happen, it's only a matter of which day, but never a matter of "if".

There are a myriad of problems that can individually catapult the world into a financial disaster. So, here are the most dangerous.

The United States government can not control its spending, debt, or deficit.

If China starts unloading US Treasuries, this could set up a treasuries and bond market collapse.

Oh, and by the way, we're not trying to scare you, but it's time to dump bonds! Like NOW!

The American economy is unwinding but American news will NOT report it. However, the same thing is happening in Canada, and they ARE reporting it! Danger, Will Robinson, we're skating on very thin ice.

Real Estate is NOT immune from this massive slow down. Mortgage re-fi's are drastically lower!

Social upheaval running throughout society will have a distinct disruptive effect on all markets and most asset classes. Emotions are running hot. This is a time to pay close attention.

Of course, it doesn't help knowing how crooked the banks and banking cartel are. This one fact has enraged millions of people. Revolution is in the air. Rebellion from the banking establishment is coming quickly.

Rebellion from the banking system will place huge demand for cryptocurrencies. The prices will radically climb to highs never imagined.

US dollar weakness and market manipulation together have guaranteed a systemic collapse.

Here is the foundation to the upcoming systemic collapse.

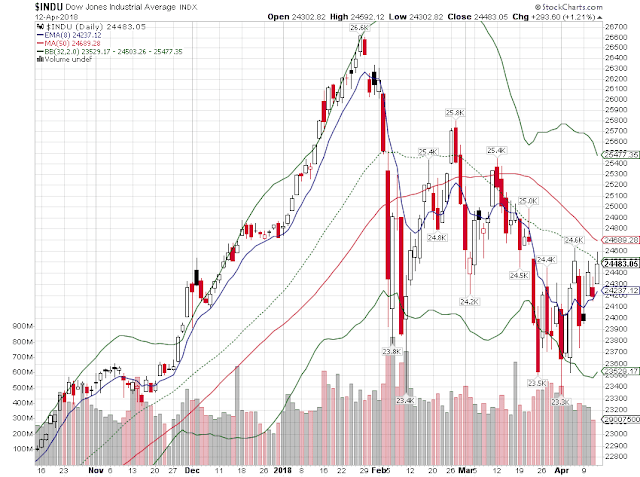

But, if that's not enough, take another look at today's DJIA Chart.

When we're in high school, we learned about the economic law of supply and demand. In the most basic sense, when demand goes up, it energizes prices to move up. So, looking at the above chart, prices are moving up on weaker and weaker demand (volume). This chart completely defies the basic economic law of supply and demand. How is that possible? Well, it's VERY possible through blatant market rigging. And again, we point to the SEC watching and doing nothing, albeit, a co-conspirator. It is a disgrace that the United States government has become so lawless. But, rest assured, when this collapse comes, it will make 2008 look like a typographical error, and most of these government co-conspirators will end up in prison. There is no "IF", just WHEN.

For you, just be patient, invest in cryptocurrencies, and don't panic. The global banking cartel has painted themselves into a corner they can not get out of.

There are a myriad of problems that can individually catapult the world into a financial disaster. So, here are the most dangerous.

The United States government can not control its spending, debt, or deficit.

If China starts unloading US Treasuries, this could set up a treasuries and bond market collapse.

Oh, and by the way, we're not trying to scare you, but it's time to dump bonds! Like NOW!

The American economy is unwinding but American news will NOT report it. However, the same thing is happening in Canada, and they ARE reporting it! Danger, Will Robinson, we're skating on very thin ice.

Real Estate is NOT immune from this massive slow down. Mortgage re-fi's are drastically lower!

Social upheaval running throughout society will have a distinct disruptive effect on all markets and most asset classes. Emotions are running hot. This is a time to pay close attention.

Of course, it doesn't help knowing how crooked the banks and banking cartel are. This one fact has enraged millions of people. Revolution is in the air. Rebellion from the banking establishment is coming quickly.

Rebellion from the banking system will place huge demand for cryptocurrencies. The prices will radically climb to highs never imagined.

US dollar weakness and market manipulation together have guaranteed a systemic collapse.

Here is the foundation to the upcoming systemic collapse.

But, if that's not enough, take another look at today's DJIA Chart.

When we're in high school, we learned about the economic law of supply and demand. In the most basic sense, when demand goes up, it energizes prices to move up. So, looking at the above chart, prices are moving up on weaker and weaker demand (volume). This chart completely defies the basic economic law of supply and demand. How is that possible? Well, it's VERY possible through blatant market rigging. And again, we point to the SEC watching and doing nothing, albeit, a co-conspirator. It is a disgrace that the United States government has become so lawless. But, rest assured, when this collapse comes, it will make 2008 look like a typographical error, and most of these government co-conspirators will end up in prison. There is no "IF", just WHEN.

For you, just be patient, invest in cryptocurrencies, and don't panic. The global banking cartel has painted themselves into a corner they can not get out of.

If that is not enough look at the bond yield curve. It is further evidence the central banks have painted themselves into a corner. Here are even some mainstream related articles. You know we are hanging from the cliff by a thread when they start spilling their guts.

ReplyDeletehttps://www.bloomberg.com/view/articles/2018-04-12/flattening-yield-curve-is-sending-message-about-fed-s-rate-plans

The Yield Curve Is Sending a Message About the Fed

The central bank is further along in the tightening cycle than its latest projections suggest.

https://www.bloomberg.com/news/articles/2018-04-09/yield-curve-entering-danger-zone-as-inversion-reappears-on-radar

Yield Curve Is Entering the Danger Zone

Two- to 10-year Treasury curve approaches narrowest since 2007

Recessions typically follow curve inversions, LaVorgna says

Additionally even the IMF is now tipping it's hand with veiled statements indicating that global trade could be headed for trouble. Interesting where they are placing the blame in the headline. But down in the article they get to the point.

ReplyDeletehttps://www.express.co.uk/news/world/945199/trade-war-latest-us-news-trump-china-imf-lagarde

IMF chief warns global rules on verge of being ‘torn apart’ as trade war looms

Ms Lagarde warned of growing trade war threats and the rapid rise in public and private debt - IMF research to be published next week will say it has reached an all-time high of $164 trillion and is 40 percent higher compared to its 2007 level, with China accounting for more than 40 percent of that increase alone.

3037ccc4-3ebb-11e8-b74f-83647224e8d3 - EXCELLENT POINTS! Thanks!

Delete